The White House’s announcement of the formation of the Council for Supply Chain Resilience is coming none too soon. There are a set of key facts facing the US Supply Chain Market today:

- Carriers have an enormous number of new vessels on order and coming on line now.

- New tonnage is driving freight rates down, although they seemed to plateau over the summer Peak Season.

- The US Economy grew at an amazing 5.2% in the 3rd quarter according to Reuters and indications are for continued strong growth.

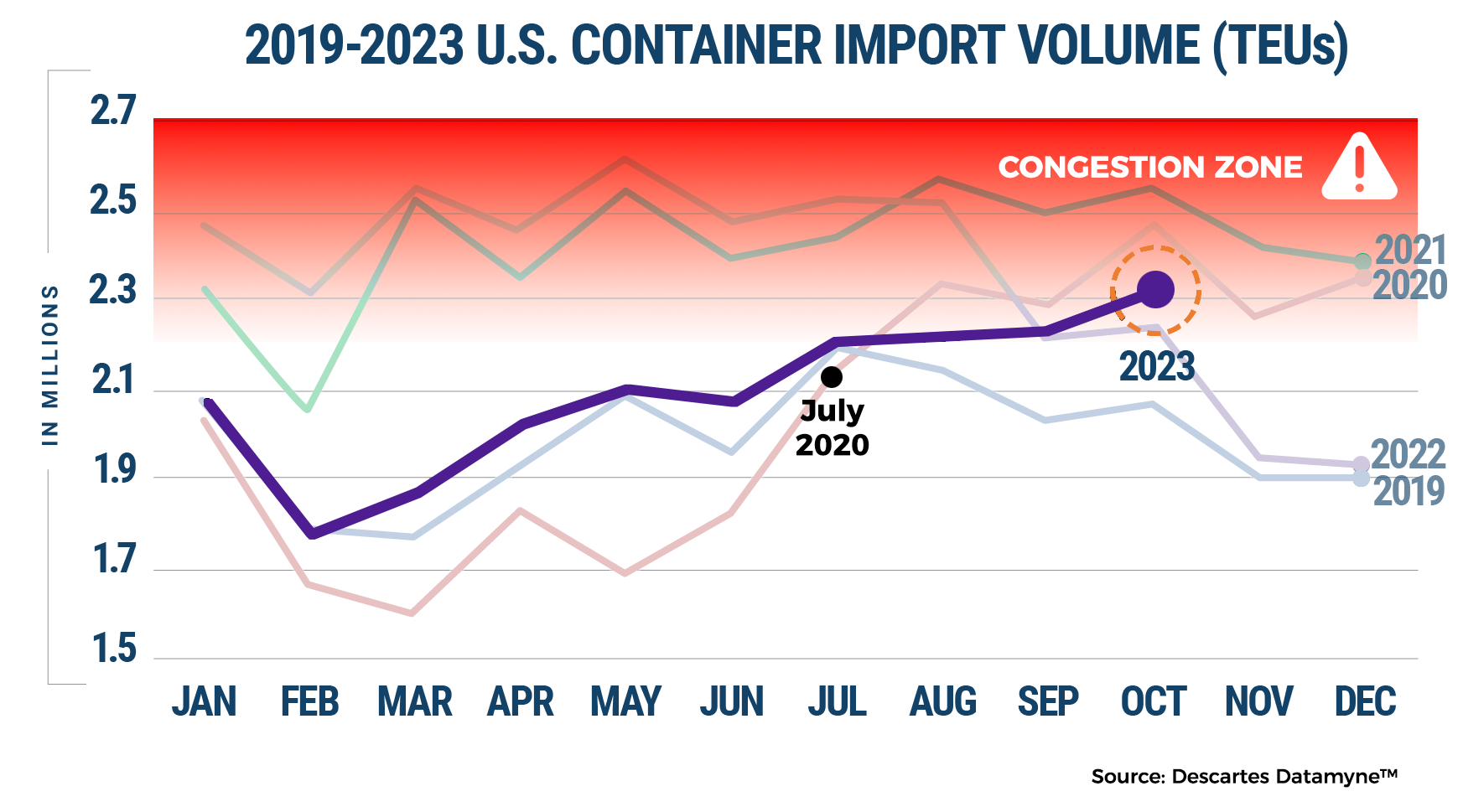

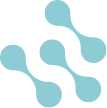

- Container movements are up from the end of last year according to Descartes’ Datamyne.

- The low water issues in the Panama Canal has significantly reduced the number of vessels that can transit the canal and avoid the US West Coast ports.

The pivotal point here is the level of container throughput in the ports. This was the bottleneck in 2020 – 2022 and will be the bottleneck again until capacity at the ports is enlarged either through capital development or process changes yielding greater efficiency.

The concern should be that October container volumes reached the same level where port congestion started in 2020. It is probably safe to project that November through February will have lower seasonal volumes but if March and beyond is normal and the economy continues to grow and carriers reroute vessels away from the Panama Canal, then we should anticipate port congestion is exactly the way we project traffic during rush hour in any large city. Congestion is just what happens when traffic volumes exceed a known point.

It’s time for the industry and the government to move forward quickly in discussing alternative ideas and concepts for process changes in cargo management. Focusing on these process changes stands a better chance of mitigating port congestion rather than waiting for several years to see capital projects implemented.

It’s time to look seriously at leveraging the data flowing to US Customs from the ocean carriers and NVOCCs as part of the 24 Hour Rule. This data includes all legal shipments, is standardized to meet US CBP’s requirements, is complete or otherwise rejected, and yields full accessible visibility that so many in the market have called for.