This is the last time that we will predict the future. The next time we write about this topic, will be April where we will then report facts. April to

Introduction The EU’s Import Control System 2 (ICS2) is a transformative initiative enhancing security and facilitating smoother trade across borders. By revolutionizing how cargo information is processed, ICS2 strengthens the

Seattle, January 22, 2024 — Trade Tech Inc., an industry-leading global logistics platform, continues its commitment to innovation by completing the rollout of Syrinx, the next generation of its fully

The second phase of the European customs import system has been postponed, and this delay allows the industry to get prepared. By Bryn Heimbeck, president and co-founder of Trade Tech,

Seattle, December 12, 2023 — Trade Tech, an industry-leading global logistics platform, is unveiling a brand refresh that includes a new logo and a new website with an emphasis on:

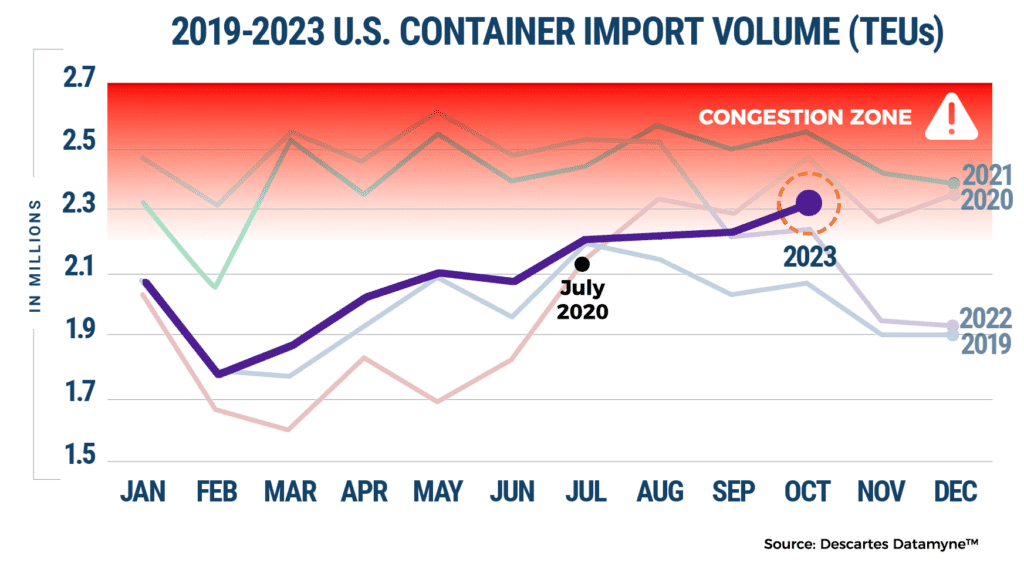

The White House’s announcement of the formation of the Council for Supply Chain Resilience is coming none too soon. There are a set of key facts facing the US Supply

Seattle, WA, December 7, 2023–Trade Tech, an industry-leading global logistics platform, announced today that it is working with ASTM International, one of the world’s largest standard development organizations, on its

Seattle, November 9, 2023 – In light of the newly announced schedule for the European Union’s Ocean Import Control System 2 (ICS2), Trade Tech, a leading provider of innovative and industry-leading

The go live for mandatory Ocean ICS2 filing has been postponed. The new go live dates are now scheduled for: Ocean ISC2: For Vessel Operators – June, 3, 2024For House

We use cookies to enhance your browsing experience, serve personalized content, and analyze our traffic. By clicking ‘Accept all’ you consent to our Privacy policy.